estate tax change proposals 2021

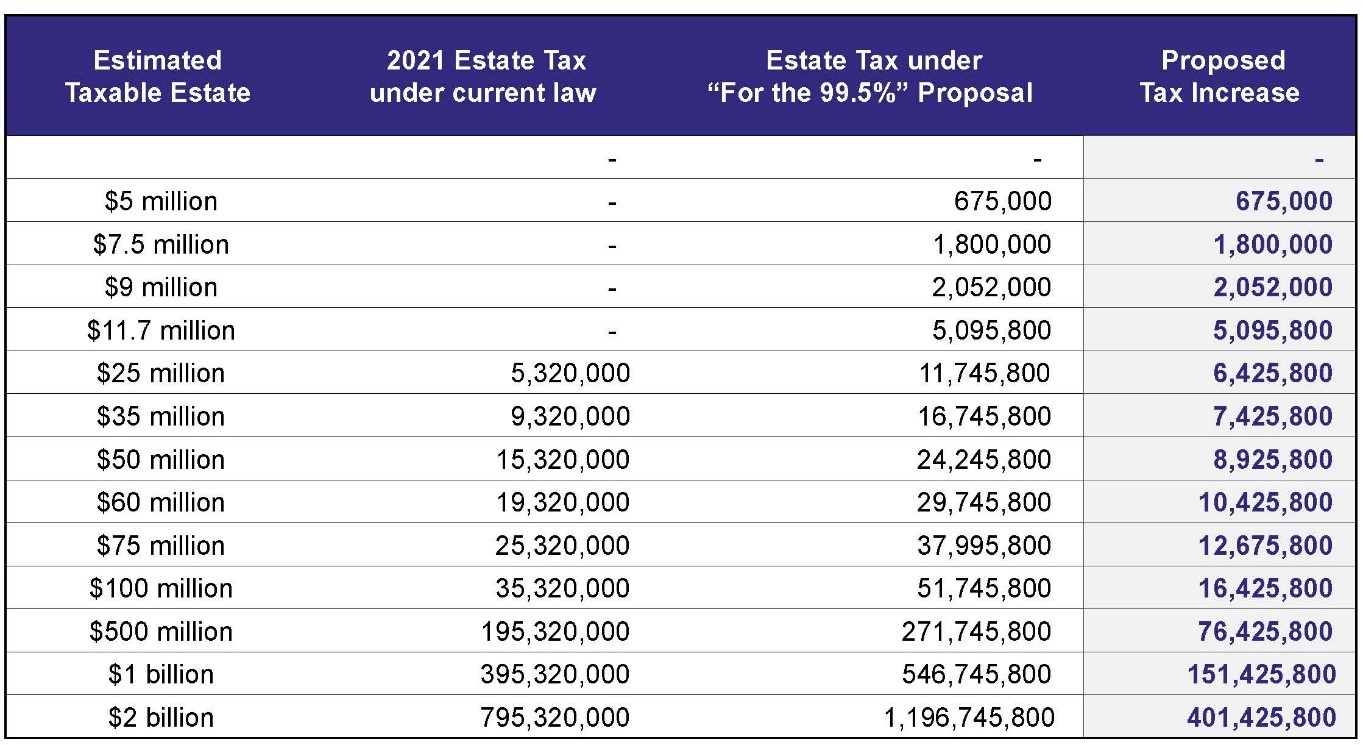

The bill would levy a 2. The current rate is 40.

Proposed Legislation To Change Estate And Gift Tax Planning Stoel Rives Llp Jdsupra

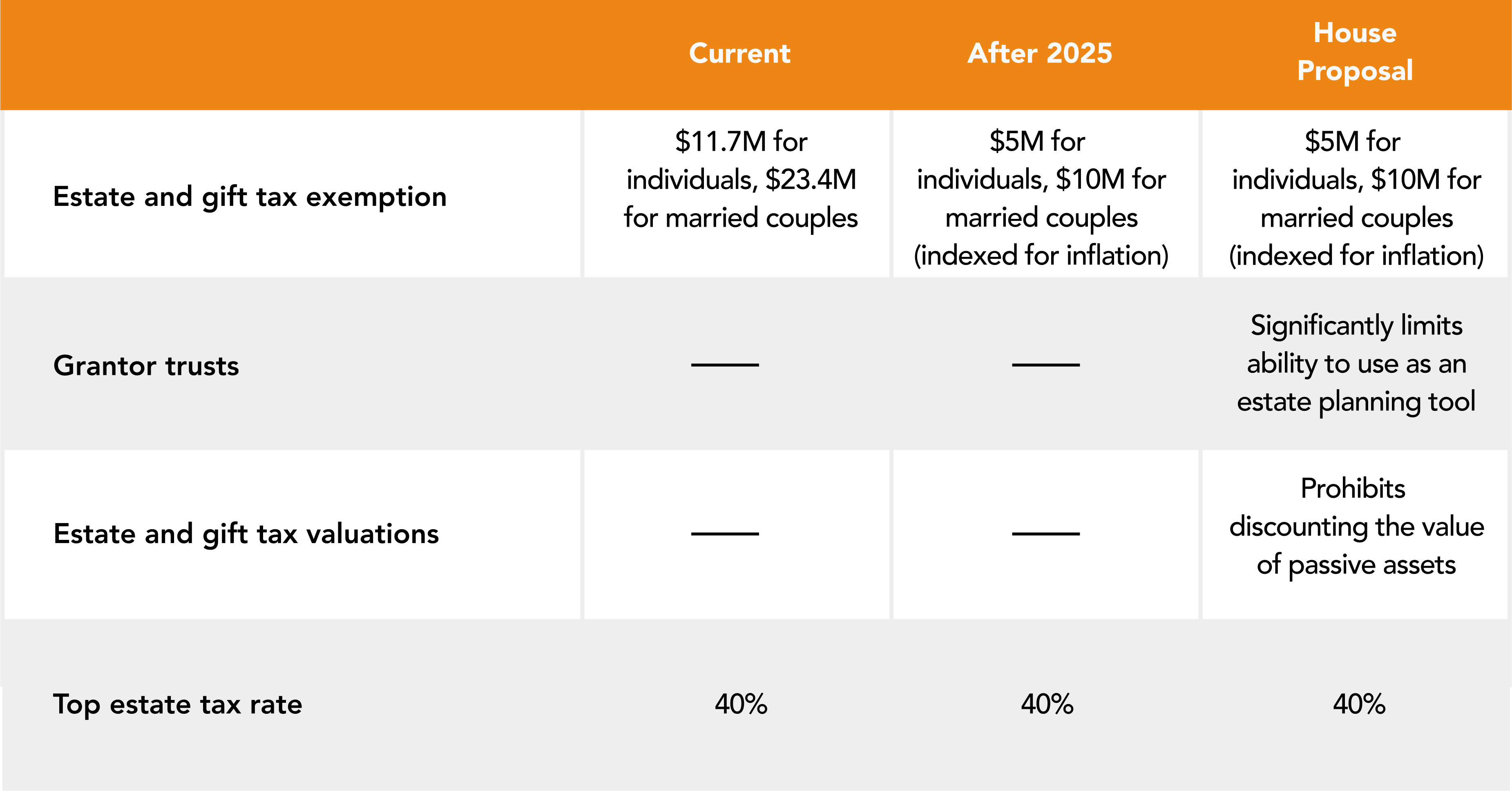

On September 21 2021 the House Ways and Means Committee the House released a comprehensive draft of the proposed statutory tax language the House Proposal.

. If these proposals were to pass in 2021 it is possible the changes would be made retroactively and affect any assets and activities after January 1 2021. Currently the exemption is 11700000 for the 2021 tax year and any reversal to the 5000000 level will likely also be indexed for inflation. Changes to the grantor trust rules.

On September 27 2021 the. And eight other Democrats proposed the Ultra-Millionaire Tax Act in early March. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

Decrease in Exemptions on State Death Taxes. The Biden campaign proposed to reduce the Estate Tax exemption amount to 35 million per person and to increase the top. Proposed Changes under Biden Administration.

Decreased from 567 million to 4 million. September 2 2021. The federal estate tax.

Under current law it is possible to create. If this proposal were to become law the potential drop in the exemption might be a reason to consider completing large gifts before year-end. Then the gift and estate.

President Joe Bidens tax plan carries some significant reforms many of which are aimed at collecting additional taxes from high-value estates. The current 2021 gift and estate tax exemption is 117 million for each US. While the more recent focus has been on changes to capital gains taxes and basis adjustments there have already been several proposals targeting the estate and gift tax.

On September 13 2021 the House Ways and Means Committee released its proposal for funding. The estate tax is a one-time tax based on the value of a deceased persons assets as of their date of death if they exceed the estate tax exemption. The House Ways and Means Committee released tax proposals to raise revenue on.

So if a resident. Tax Laws May Change Under President Biden. Amounts from 35 million to 10 million would be taxed at 45 from 10 million to 50 million would be taxed at 50 from 50 million to 1 billion would be taxed.

This amount could increase some in 2022 due to adjustments for inflation. This legislation would lower the estate tax exemption to 35 million for individuals and 7 million for married couples at a 45 rate and gradually increase the rate to 65 for. November 16 2021 by admin.

For the last 20 years the. The 2021 exemption is 117M and half of that would be 585M. The exemption was indexed for inflation and as of 2021 currently.

The 2017 Trump Tax Cuts raised the Federal Estate Tax Exemption to 1118 million for tax year 2018. This year has brought many proposals to Congress that would dramatically change the tax implications for many farm businesses. As of January 1 2021 the death tax exemption in Washington DC.

Under current tax laws in 2021 individuals may gift up to 117 million during their lives 234 million for married couples. Potential Estate Tax Law Changes To Watch in 2021.

Here S How Democrats Want To Raise Taxes On The Rich

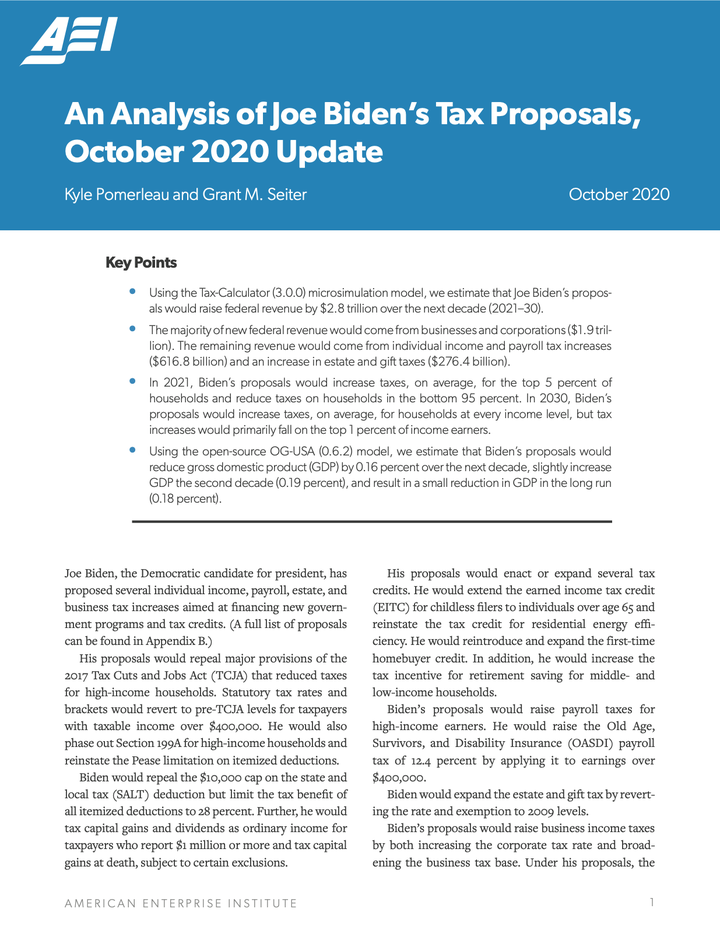

An Analysis Of Joe Biden S Tax Proposals October 2020 Update Grant M Seiter

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

Estate And Gift Taxes 2021 2022 What S New This Year And What You Need To Know Wsj

Senate Proposals To Change Estate Tax And Stepped Up Basis Lex Nova Law Llc

:max_bytes(150000):strip_icc()/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

Planning Now For The Estate Tax Overhaul Sax Wealth Advisors Llc

How Could We Reform The Estate Tax Tax Policy Center

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Here S How Many People Pay The Estate Tax

![]()

Death Taxes Real Estate Warrington

Income Estate Capital Gains Tax Hikes Retirement Account Crackdown House Finally Details How It Will Fund 3 5 Trillion Social Policy Plan

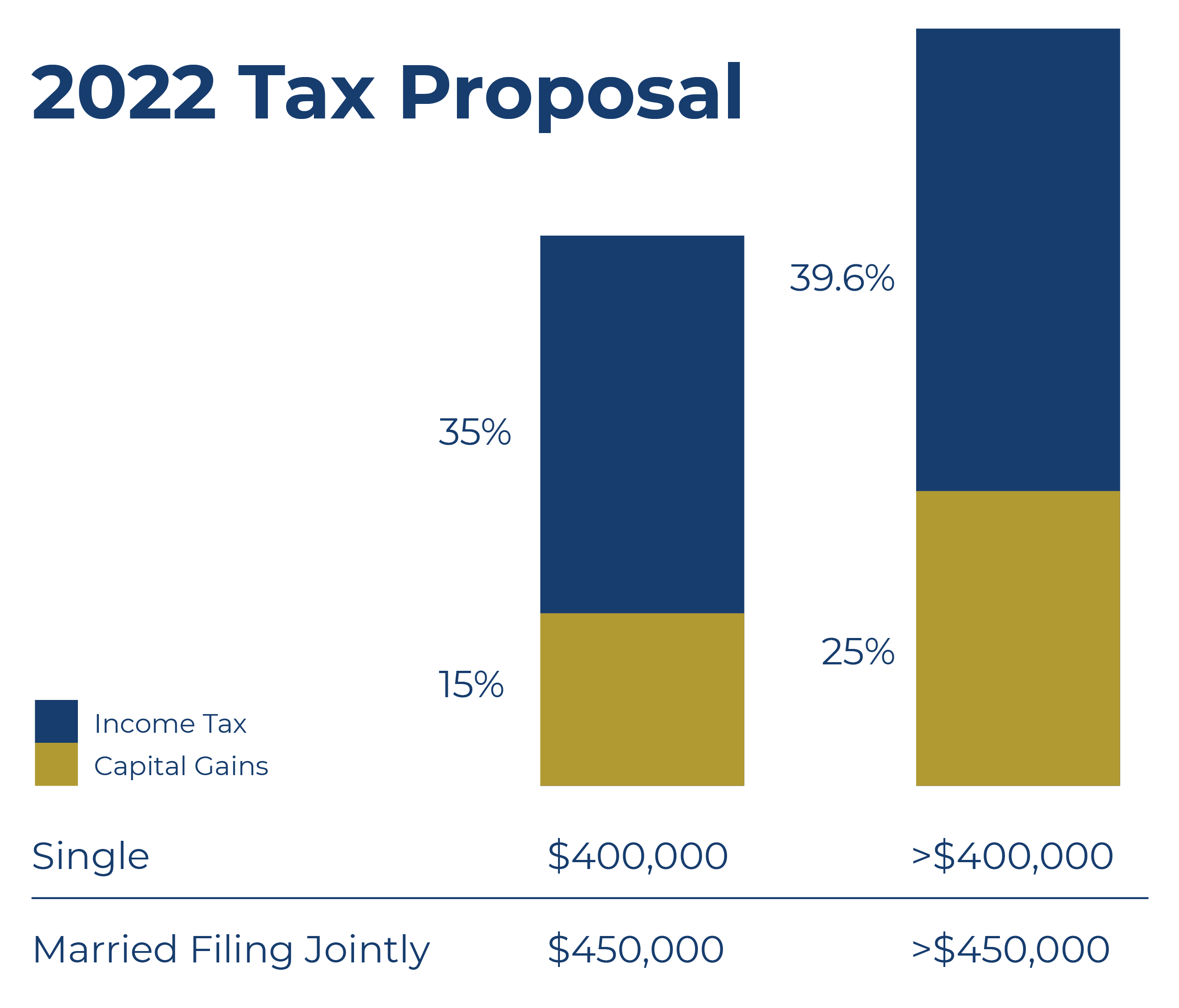

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

Estate Planning In A Biden Administration Denha Associates Pllc

American Families Plan Tax Proposal A I Financial Services